20+ Online tax estimator

Internal Sources and Online Research. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Accelerated Electronic Funds Transfer EFT Through December 31 2013.

. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Individual Income Tax Return or Form 1040-SR US. TPC is made up of nationally recognized experts in tax budget and social policy who have served at the highest levels of government.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. H and R block Skip to content. The employee Medicare tax is 261 145 tax on 100 plus 116 on 80 wages.

1 online tax filing solution for self-employed. Self-Employed defined as a return with a Schedule CC-EZ tax form. Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another.

Tuesday September 20 600pm. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. This rate is different to the flat rate of 20.

The Tax Policy Center is a joint venture of the Urban Institute and Brookings Institution. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Section 179 deduction dollar limits.

See IRM 3520281 Identity Theft Indicator andor IRM 3520282 Identity Theft Procedures for Photocopy Requests. If wage payment is. One mill is equal to 1 of tax for every 1000 in assessed value.

The first 50 payment is due on the 20th day of. Use this table to figure the amount of social security and Medicare taxes to withhold from each wage payment. Pre-tax deductions such as workplace giving are arrangements where you make a donation to a charity and the donation.

It aims to provide independent analyses of current and longer-term tax issues and to communicate its analyses to the. Gift card will be mailed approximately two weeks. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021.

This tax estimator is based on the average millage rate of all Broward municipalities. Added information on requesting Foreign Account Tax Compliance Act FATCA. Taxes File taxes online Simple steps easy tools.

Your Taxes may be higher or lower. Ohio Property Tax Rates. Referring client will receive a 20 gift card for each valid new client referred limit two.

Tax Return for Seniors. On or before the 20 th day of the month following the quarter. On or before the 20 th day of the following month.

If the Form Type on Line 6 of the request is for Form 706 or Form 709 bypass the ID Theft Indicators and process the request if valid authorization is attached. Mortgage rates valid as of 31 Aug 2022 0919 am. This deduction created by the 2017 Tax Cuts and Jobs Act allows non-corporate taxpayers to deduct up to 20 of their qualified business income QBI plus up to 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Property tax rates in Ohio are expressed as millage rates.

A pay period can be weekly fortnightly or monthly. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Dark Brown or Iceberg.

Internal Sources and Online Research. Rates vary by school district city and county. Americas 1 tax preparation provider.

Find new and used cars for sale on Microsoft Start Autos. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Removed Below Line Self Employment Deduction 572021.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Support for S Corp vs C Corp added 1202021. 1 online tax filing solution for self-employed.

Connect with us online by phone or in person. Get a great deal on a great car and all the information you need to make a smart purchase. Available in TurboTax Self-Employed and TurboTax Live.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Watch Meetings Live More City Council Meetings.

Half Leather - 0911mm. Is an American multinational technology company that specializes in consumer electronics software and online services headquartered in Cupertino California United StatesApple is the largest technology company by revenue totaling US3658 billion in 2021 and as of June 2022 is the worlds biggest company by market capitalization the fourth-largest. The effective tax rate estimator works because its a single amount thats comparable across income levels making it ideal to compare potential tax strategies.

TurboTax Free customers are entitled to a payment of 999. Added source information for the CDW Knowledge Graph Environment CKGE. Added a note under the life insurance sections to address the sale of a life.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. Support for 2021 taxes added 422021. For example on a wage payment of 180 the employee social security tax is 1116 620 tax on 100 plus 496 on 80 wages.

The tax under section 594 consists of the sum of a a partial tax computed on Form 1120 on the taxable income of the bank determined without regard to income or deductions allocable to the life insurance department and b a partial tax on the taxable income computed on Form 1120-L of the life insurance department. You must also file Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax-Favored Accounts if. Senior Exemptions are not taken into account for the estimated tax amount.

Report Online 510 981-2489 Visit. If you would like to calculate the estimated taxes on a specific property use the tax estimator on the. Electronic Funds Transfer EFT On or before the 20 th of the following month.

The Estimated Tax is just that an estimated value based upon the average Millage Rate of 200131 mills or 200131. This is the actual price paid per share times the number of shares 20 x 100 2000 plus any amounts reported as compensation income on your 2021 tax return 2500. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

L 880 x W 9401670 x H 5101030 mm. 4x4 Joint Task Force Committee on Housing Meeting. Report the 10 additional tax on Schedule 2 Form 1040 Additional Taxes PDF and attach to your Form 1040 US.

2180 Milvia St Berkeley CA 94704. This product feature is only available after you finish and file in a self. Seat with Pocket Spring Webbing.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property.

3 Ways To Calculate Your 2021 Tax Instalments

Top 7 Tax Tips For Self Employed And Small Businesses

Schedule K 1 Federal Tax Form What Is It And Who Is It For

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

Event Planning Excel Template Inspirational Top 10 Excel Dashboard Spreadsheet Template Event Planning Spreadsheet Event Planning Template Spreadsheet Template

20 Squawkfox Debt Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Spreadsheets Templates

Property Inspection Reports Template Best Of Free Home Inspection Report Template Home Inspection Report Template Report Card Template

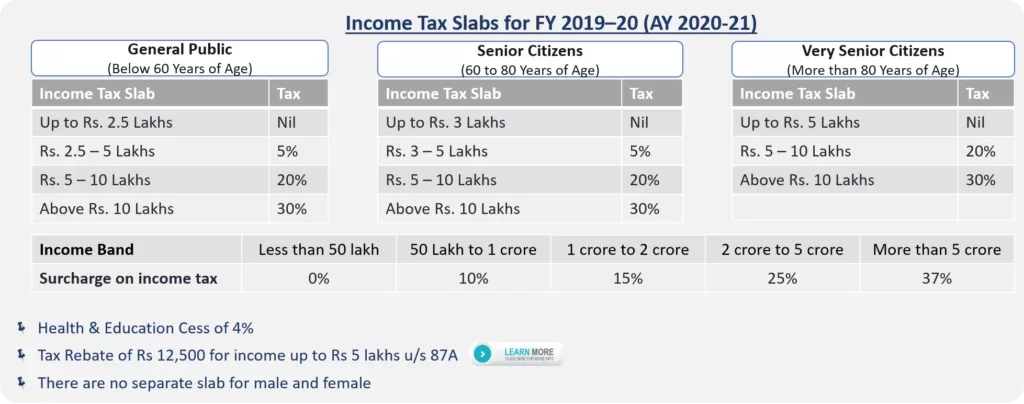

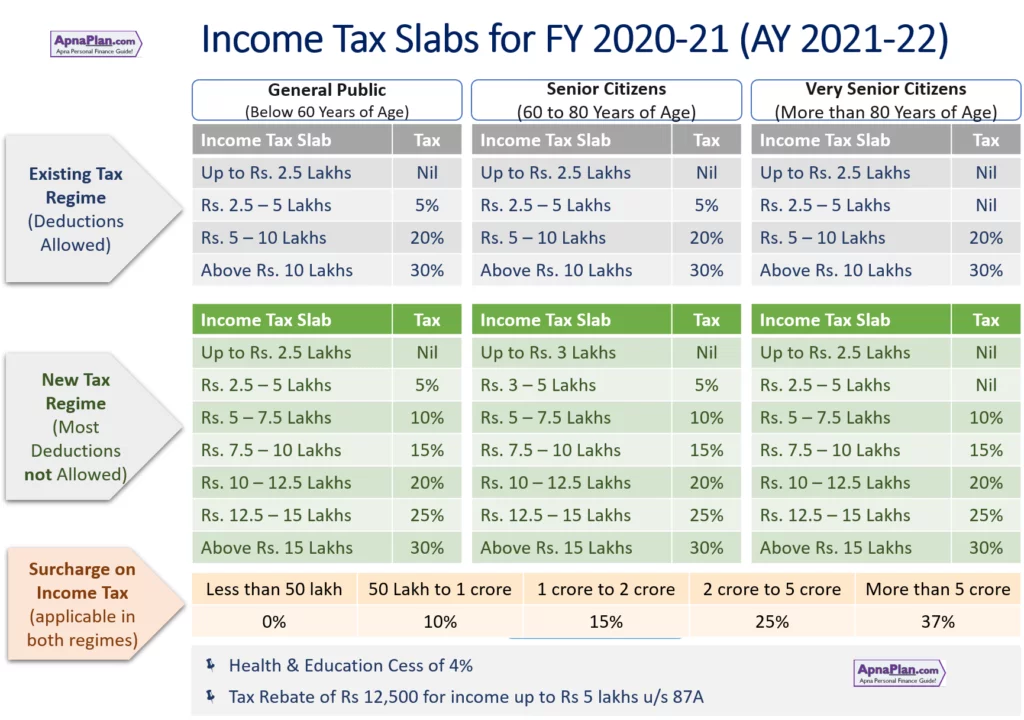

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Bid Form Template Free Best Of 31 Best Silent Auction Bid Sheet Templates Images On Silent Auction Bid Sheets Auction Bid Silent Auction Donations

Trew Marketing Message Map Snapshot Example Attendancemarketing Vcc Funny Dating Quotes Messages Marketing

![]()

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

6 Work Estimate Templates Free Word Excel Formats Estimate Template Spreadsheet Template Templates

20 Free Balance Sheet Templates In Ms Excel And Ms Word Besty Templates Balance Sheet Balance Sheet Template Balance

Pin On Business Icons Design Behance

Pin On Business Boss Woman

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Have You Been Blowing Off Your Small Business Bookkeeping Check Out This List Of Small B Business Management Small Business Finance Small Business Bookkeeping